As debates over corporate tax policy raged last year, John Samuels LLM ’75 was an oasis of calm: As vice president and senior tax counsel for General Electric, Samuels, 67, has built the firm’s global tax operation into the equivalent of a giant tax firm, with approximately 1,200 tax experts in 44 countries, and a reputation as one of the most aggressive corporate tax operations.

Big enough and aggressive enough, that is, to make the front page of the New York Times in 2011 in a scathing and much-talked-about piece about just how little tax GE pays. It’s all in a day’s work for Samuels, who describes GE’s tax techniques as akin to individual homeowners claiming the home mortgage interest deduction to lower their taxes.

“The government puts incentives out there, and we take advantage of them,” Samuels says simply. “That’s the obligation we have to shareholders.”

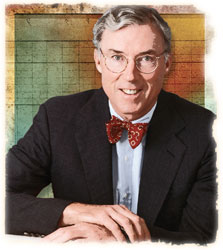

A tall and dapper man, wearing a polka-dot yellow bow tie on the day I met him at his satellite office in Stamford, Connecticut, Samuels is one of the Graduate Tax Program’s most successful alums, though he prefers to keep a low profile. From his perch at GE over the past 25 years, Samuels has helped change the way corporations think about their taxes and the importance tax strategy can have on the bottom line. And with his founding of the International Tax Policy Forum—a Washington, DC-based tax think tank whose members include more than 40 US-based multinationals—and frequent appearances at tax-policy events, Samuels is one of the corporate sector’s most prominent voices on international tax issues. Tax Business, an international magazine, once ranked him the most influential person in the tax world, calling him “famous for crafting clever tax plans and groundbreaking deals with the US and foreign fiscal authorities.”

A tall and dapper man, wearing a polka-dot yellow bow tie on the day I met him at his satellite office in Stamford, Connecticut, Samuels is one of the Graduate Tax Program’s most successful alums, though he prefers to keep a low profile. From his perch at GE over the past 25 years, Samuels has helped change the way corporations think about their taxes and the importance tax strategy can have on the bottom line. And with his founding of the International Tax Policy Forum—a Washington, DC-based tax think tank whose members include more than 40 US-based multinationals—and frequent appearances at tax-policy events, Samuels is one of the corporate sector’s most prominent voices on international tax issues. Tax Business, an international magazine, once ranked him the most influential person in the tax world, calling him “famous for crafting clever tax plans and groundbreaking deals with the US and foreign fiscal authorities.”

Samuels grew up in the small Florida town of Hollywood, where his father was a lawyer and the kids were expected to be either doctors or lawyers. At Vanderbilt University, Samuels was pre-med, until he realized that he didn’t want to go to the hospital every morning and see sick people. He got his law degree at the University of Chicago, where he studied with eminent tax scholar Walter Blum. “Very few people did tax,” Samuels says. “I started it, and loved it. You have to actually learn a body of law.”

At Dewey Ballantine, first in New York and then in Washington, DC, Samuels honed his interest in tax law. When Jimmy Carter was elected president in 1976, word went around the office that his administration wanted new faces at Treasury. “Like all new presidents,” Samuels says, “he was going to reform the tax code.” Samuels joined Treasury as deputy tax legislative counsel and rose to become tax legislative counsel.

After Carter lost re-election, Samuels returned to Dewey Ballantine, where he was a partner, and shuttled between his practice in the capital and in New York, where his clients included Bankers Trust and HBO.

In 1987, Jack Welch, GE’s legendary chief executive, hired Ben Heineman, a constitutional lawyer, as general counsel in a new effort to build a significant in-house legal department. It was unusual then for companies to hire high-powered lawyers in-house, and considered a poor career move for top lawyers to make. “Heineman started this revolution of bringing senior lawyers in-house,” Samuels says. It wasn’t long before Heineman was courting Samuels to join.

At first, Samuels figured he’d just meet with the GE executives in order “to hustle a client,” as he recalls, “because that’s what you do in a law firm is hustle clients.” Instead, he came away from the meetings seriously considering the job. “I could feel the draw of the opportunity to build something new,” he says. But the risks loomed large, and Samuels was afraid: After all, he was a top-billing law partner at a top law firm with an interest in government service at a time when few ambitious lawyers would choose to go in-house. Would he be making a career mistake? Would he be able to convince other top tax lawyers to join him at GE? M. Carr Ferguson LLM ’60, who was one of Samuels’s professors at NYU Law and remains a friend, recalls meeting with Samuels in New York as he agonized over whether to leave Dewey Ballantine for GE. The two had worked in Washington during the Carter administration, when Ferguson was assistant attorney general in charge of the tax division at the Department of Justice and Samuels was at Treasury. They had even, very briefly, been roommates there. “I strongly recommended he take the job; it sounded spectacular, and I think it has been for him,” Ferguson says. “I thought that was an endearing characteristic of John’s—his great loyalty and great appreciation of the law as a calling.”

With Welch’s imprimatur to hire, Samuels soon brought in young partners with deep knowledge of tax for GE’s business units, like GE Capital and the aircraft business. And as GE expanded overseas, he added tax lawyers in countries like Brazil and China. “When I came here, there were 40 or 50 people in the tax group, and none of them had tax backgrounds. There was low-hanging fruit everywhere. Everyone thought I was a genius, and I’m not and was not,” Samuels says. Still, as other corporations built up their in-house expertise, Samuels says: “I think we set the model.”

Samuels once thought he’d return to government, but over the years has cut off feelers to be assistant secretary for tax policy at Treasury and commissioner of the Internal Revenue Service, unwilling to deal with the revolving door that is Washington. Instead, he keeps on signing GE’s voluminous tax return, and spends time flyfishing (in the Bahamas and the Florida Keys), playing golf, and going to the opera with his wife, Diane, a retired teacher of children with learning disabilities. The family’s ties to NYU Law remain strong: His daughter Sarah Samuels, an associate at Skadden, Arps, Slate, Meagher & Flom, and her husband, Isaac Wheeler, a tax associate at Sullivan & Cromwell, both graduated in 2009. But even as Samuels can look back on a long and successful career, don’t count on his retiring anytime soon. Says he: “I’ll never go to Florida and play golf. There’s at least another chapter or two.”

—