A Scholar with Big Pages to Fill

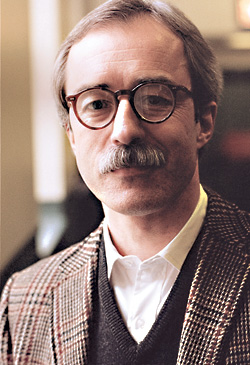

Printer Friendly Version Professor John P. Steines Jr. (LL.M. ’78) has been named the new author of Federal Income Taxation of Corporations and Shareholders, the preeminent work on corporate taxation that for decades was co-authored by Boris Bittker, a Yale Law School professor who died in 2005, and James Eustice (LL.M. ’58), Gerald L. Wallace Professor of Taxation Emeritus at NYU Law, who passed away in 2011. “Say ‘B and E’ to any tax lawyer and they will know instantly to what you are referring,” said Ronald and Marilynn Grossman Professor of Taxation Deborah Schenk (LL.M. ’76) in her remembrance of Eustice. “It is on every tax lawyer’s desk, in every law library, and read by generations of corporate tax students. It is the first place everyone looks for an answer to any corporate tax question, and, as I say to my students, if the answer isn’t there, there is no answer.”

Professor John P. Steines Jr. (LL.M. ’78) has been named the new author of Federal Income Taxation of Corporations and Shareholders, the preeminent work on corporate taxation that for decades was co-authored by Boris Bittker, a Yale Law School professor who died in 2005, and James Eustice (LL.M. ’58), Gerald L. Wallace Professor of Taxation Emeritus at NYU Law, who passed away in 2011. “Say ‘B and E’ to any tax lawyer and they will know instantly to what you are referring,” said Ronald and Marilynn Grossman Professor of Taxation Deborah Schenk (LL.M. ’76) in her remembrance of Eustice. “It is on every tax lawyer’s desk, in every law library, and read by generations of corporate tax students. It is the first place everyone looks for an answer to any corporate tax question, and, as I say to my students, if the answer isn’t there, there is no answer.”

Steines acknowledges that he has accepted a huge undertaking: “I am deeply honored to follow in the footsteps of Jim and of Boris Bittker and am keenly aware of the enormity of creating a new edition that reflects the last decade of incredibly complicated tax law with style and substance worthy of its predecessors.” Not only does he have decades of experience and scholarship in tax law, but he also had a long working relationship with Eustice that he can refer to. Steines co-taught a course on consolidated tax returns with Eustice and William Lesse Castleberry, and for many years Steines and Eustice were counsel to the tax practice at Cooley. Adjunct Professor Stephen Gardner (LL.M. ’65) applauded the selection of Steines, saying, “He will bring both his vast experience in corporate taxation and his extensive collaboration with Jim Eustice to the maintenance of this unparalleled work.”

Steines is the author of the casebook International Aspects of U.S. Income Taxation as well as articles on corporate, partnership, and international tax issues. A former editor-in- chief of the Tax Law Review, he has provided expert testimony on tax-related controversies and instructed IRS employees. Given all of this experience, he compares the tremendous task of updating the treatise with gardening. “The book is a diverse vineyard with ancient vines in need of gentle pruning and newer cultures that need more light,” he says. “I look forward to the gardening and am committed to maintaining the book’s preeminence.”

—